How to Tackle Overseas Production Under US High Tariffs? UPNPI Eliminates Tariff and Union Risks with Packaged R&D-Production Solutions

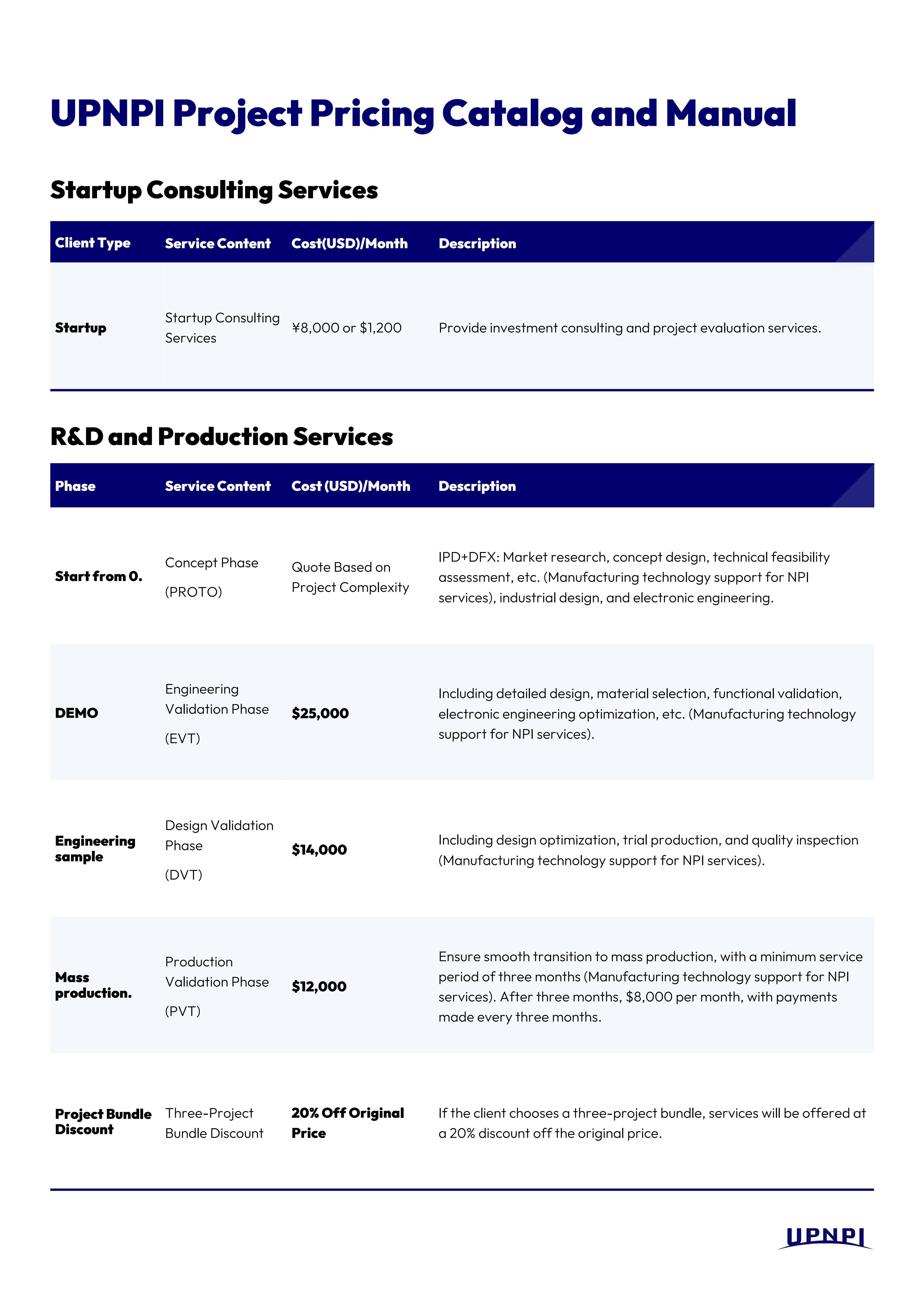

15+ Years of Expertise + 100+ Engineer Team with Extensive Experience – Design Flaws Eliminated at B

I. The "Death Loop" of American Manufacturing: How High Tariffs and Labor Costs Drain Profits

- In 2025, the average US import tariff on electronic devices has soared to 125%-3521% (US Department of Commerce data), while the average annual salary for local hardware engineers reaches $140,600 (Built In data), and industrial designers command $67,500. This creates a triple crisis:

Design Cost Explosion: Salaries for 2 senior US hardware engineers ≈ annual service fee for UPNPI’s 15-year experienced R&D-production team.

Mass Production Risks: 73% of local projects exceed costs by 30%+ in mass production due to design-manufacturing disconnect (UPNPI internal data).

Time Black Hole: Relying on 1-2 engineers causes average delays of 180 days per problem.

Case in Point: A Boston smart lock startup had to scrap 30% of its circuit design pre-mass production due to UL certification oversights, incurring $500,000 extra costs and 3-month delays.II. The US R&D Dilemma: The Fatal Gap Between Technology and Production

1. The Price of "Theoretical" Engineering

Silicon Valley hardware entrepreneurs on LinkedIn forums commonly report: 92% of hardware engineers lack factory hands-on experience, leading to "hell-level" obstacles during mass production. For example, a wearables company’s engineers ignored injection molding tolerance requirements, causing a 40% mold scrap rate and 6-month project delays.Industry Pain Points:Design-Production Disconnect: US engineers chase "perfect parameters" in CAD software but ignore real-world capabilities of Chinese supply chains. A smart speaker project failed as 30% of PCBs (Printed Circuit Boards) overheated during production due to unconsidered soldering temperature thresholds.

Inefficient Cross-Department Collaboration: BCG research shows 82% of US hardware companies have "information silos" between R&D and production, with design changes taking 3-4 approval layers and 28-day delays on average.

2. The "Innovation Chasm" in Production

The National Academy of Engineering highlights the lack of integration between manufacturing and innovation as a core weakness. A Texas medical device company’s new catheter design required clinical trial rework due to uncommunicated FDA standards, costing over $2 million.Real-World Data:Pilot Production Iterations: US teams average 5-7 iterations, while UPNPI’s "Production Radar" reduces this to just 2 via risk prediction.

Yield Gap: US smartwatch projects average 62% yield, vs. 98% after UPNPI optimization (data from a Silicon Valley smart home brand).

3. Voices from Forums and Social Media

Reddit Hardware Forum: An anonymous engineer complained: "Our San Francisco-designed drone failed salt spray testing in Shenzhen – the entire motor bracket needed redesign."

Facebook Hardware Entrepreneurs Group: A founder shared: "US-engineered smartwatch casings ignored CNC machining minimum hole size, tripling production costs."

LinkedIn Industry Report: McKinsey found 63% of US hardware companies fail at mass production due to design flaws, vs. 19% for Chinese supply chain projects.

III. UPNPI’s Breakthrough Formula: 100+ Engineer Team with Extensive Experience × 15+ Years Experience = Zero-Risk Mass Production

1. Stage-Based Team Operations: Precision Strike from R&D to Production

Project Phase UPNPI Team Composition Core Value Delivered Concept Design 3 Hardware Engineers + 2 Industrial Designers Pre-identify 21 high-tariff material combinations; reduce BOM (Bill of Materials) costs by 12% via space optimization. Prototype Development 5 Hardware Engineers + 3 Structural Engineers Pass FCC certification on first try (local teams average 3 retries), saving $200,000 and 2 months. Pilot Production 4 Process Engineers + 2 Quality Engineers Improve screen lamination yield from 75% to 95% for a California smartwatch factory, cutting labor costs by $8/unit. Mass Production Escort 3 On-Site Engineers + 2 Supply Chain Experts Maintain 80% production during Michigan strikes via dual-shift backup (industry average: 2-week shutdown). Data Support: A smart home kit saw composite tariffs drop from 187% to 12% with UPNPI, cutting container costs by $42,000.2. Experience Moat: 15 Years of Production-Ready Design Insights

Circuit Design: Master NA safety standards (UL62368) and EMC (Electromagnetic Compatibility) certification; pre-install shielding structures for a wireless earbud project to avoid post-production recalls.

Structural Design: Optimize modular snap-fit designs during ID phase to cut robot vacuum assembly time by 40%, addressing US labor cost challenges.

Supply Chain Adaptation: Leverage Shenzhen’s 3,000+ suppliers to switch components within 72 hours for a Texas smartwatch client during a 2023 chip shortage.

Performance Comparison:Key Dimension US Fragmented Engineer Model UPNPI 100+ Engineer Team with Extensive Experience Model Issue Response Time 1-2 weeks of outsourcing coordination 24-hour cross-engineer collaboration Hidden Cost Control 30%+ cost overruns 90%+ risk prediction at design stage Yield Assurance 62% (smartwatch project) 98% (after UPNPI optimization) IV. Cost Reconstruction: From "High-Cost Hiring" to "Technical Partnership"

1. Labor Cost Precision

Salary Parity: 2 US hardware engineers’ annual salary ≈ 1-year service fee for UPNPI’s 10-engineer team.

Efficiency Leverage: 40% shorter development cycles and 75% faster problem-solving in pilot stages via phased team involvement (reference to Daya Bay Nuclear data).

Risk Hedging: 12-15 years average experience per engineer, 50+ mass production projects delivered – avoiding "ghost engineer" inefficiencies (95% of Silicon Valley engineers lack mass production skills, 51CTO data).

2. Full-Cycle Cost Model for US Companies

For a 1-year project:R&D Phase: 5 Hardware Engineers + 3 Industrial Designers – $82,000/month (including travel).

Production Phase: 3 Process Engineers + 2 Quality Engineers – $65,000/month (including on-site subsidies).

Total Cost: ~$1.76M – 75% less than local teams.

Hidden Value: "Production Radar" avoids $500,000–$2,000,000 in rework costs per project due to design flaws.V. From "Made in China" to "Sino-US Dual-Drive": The Ultimate Solution

While US engineers struggle with FCC certifications, UPNPI delivers:Technology Transfer: Deploy 5 senior engineers to set up US production lines, retaining Shenzhen supply chain advantages while avoiding tariffs.

Knowledge Accumulation: Generate Mass Production Risk Database for reusable technical assets per project.

Long-Term Escort: Hourly billing for production-stage engineers, with emergency response ≤4 hours to avoid fixed cost burdens.

Silicon Valley Validation: A hardware founder shared, "UPNPI’s team is like a mass production manual in human form – tariff and rework savings alone fund another project."VI. Dual Strategy: Neutralizing Union Risks & Tariff Costs

1. Union Risk Mitigation: Technology-Driven Flexibility

Automation: Transfer Shenzhen smart production lines to Michigan, achieving 85% automation rate to reduce labor dependency.

Flexible Staffing: "Core Team + Temporary Workers" model avoids long-term union conflicts.

Cultural Integration: Engineer teams work alongside local workers, reducing management friction via technical empowerment.

Case Study: Fuyao Glass avoided union disruptions through tech upgrades, achieving 95% yield (Jiemian News data).2. Tariff Avoidance: "Shenzhen R&D + US Production" Dual Hub

Supply Chain Split: Process high-tariff components (e.g., PCBs) in Shenzhen, assemble in the US for low-tariff status.

Local Production: Set up assembly bases in Texas, enjoying 12% tariff discounts as "Made in USA" (US Department of Commerce data).

Policy Adaptation: Leverage "20% US Origin Component Exemption" to reduce a smart home kit’s tariff from 35% to 0% (Xueqiu data).

Data Comparison: A drone project saw 42% cost reduction and 50% shorter delivery via UPNPI’s dual hub.VII. Conclusion: 100+ Engineer Team with Extensive Experience – Your Mass Production Escort

In the dual squeeze of high tariffs and labor costs, the solo engineer model is obsolete. Choose UPNPI for a battle-tested technical team:15 years of experience to navigate 99% of potential pitfalls

Ready-to-deploy solutions for every stage from blueprint design to factory floor production

A partner, not just a service provider, to future-proof your hardware projects

Act Now: Secure your 100+ Engineer Team with Extensive Experience Custom Solution and let the dual engines of Shenzhen speed and US compliance drive your North American success, even under 3521% tariff storms.Contact UPNPI today to turn tariff challenges into market opportunities.